#12: Adyen processed 2,000,000,000 network tokens and other news

Hi!

Here are the top 5 payments news of the week.

What payment topics are you interested in discussing? Let us know just by replying to this email!

1. Card schemes may not increase interchange fees after all. But it is not that straightforward

During an investor presentation, Mastercard's CEO, Michael Miebach, denied recent claims made by the Wall Street Journal that Mastercard and Visa would be raising credit card interchange and network fees for merchants later this year. Miebach clarified that the reporting failed to distinguish between various fees and misrepresented the situation. The Wall Street Journal had reported that fee increases were scheduled to start in October and April, potentially costing merchants an additional $502 million annually. The Credit Card Competition Act proposal, currently pending in Congress, would increase federal regulation of credit card transactions, with merchant and retail trade groups in support of it as a means to reduce fees for their members. While Mastercard and Visa are facing opposition to the bill from bank and payment trade groups, Visa has stated that it has not significantly increased fees and has even reduced them for some businesses, emphasizing its role in combating fraud. Read more

2. Adyen processed 2 BLN (with a B) network tokens

Adyen has achieved a significant milestone by issuing more than 2 billion network tokens. The tokens facilitate secure transactions, without compromising the customer experience. Adyen explained in a press release that tokenization, which transforms ordinary card numbers into secure non-sensitive tokens, has enabled businesses to boost their authorization rates by an average of 3%. This increase in authorization rates translates to a substantial increase in monthly revenue, particularly benefiting subscription or digital businesses that offer "save card details" features for easier online shopping.

Network tokens are not only more secure but also cheaper to process than primary account number card payments, allowing businesses to reduce costs while improving transaction approval rates and revenue. Trevor Nies, Adyen's Global Head of Digital, hailed network tokenization as a powerful tool that enhances both customer security and business revenue. Read more

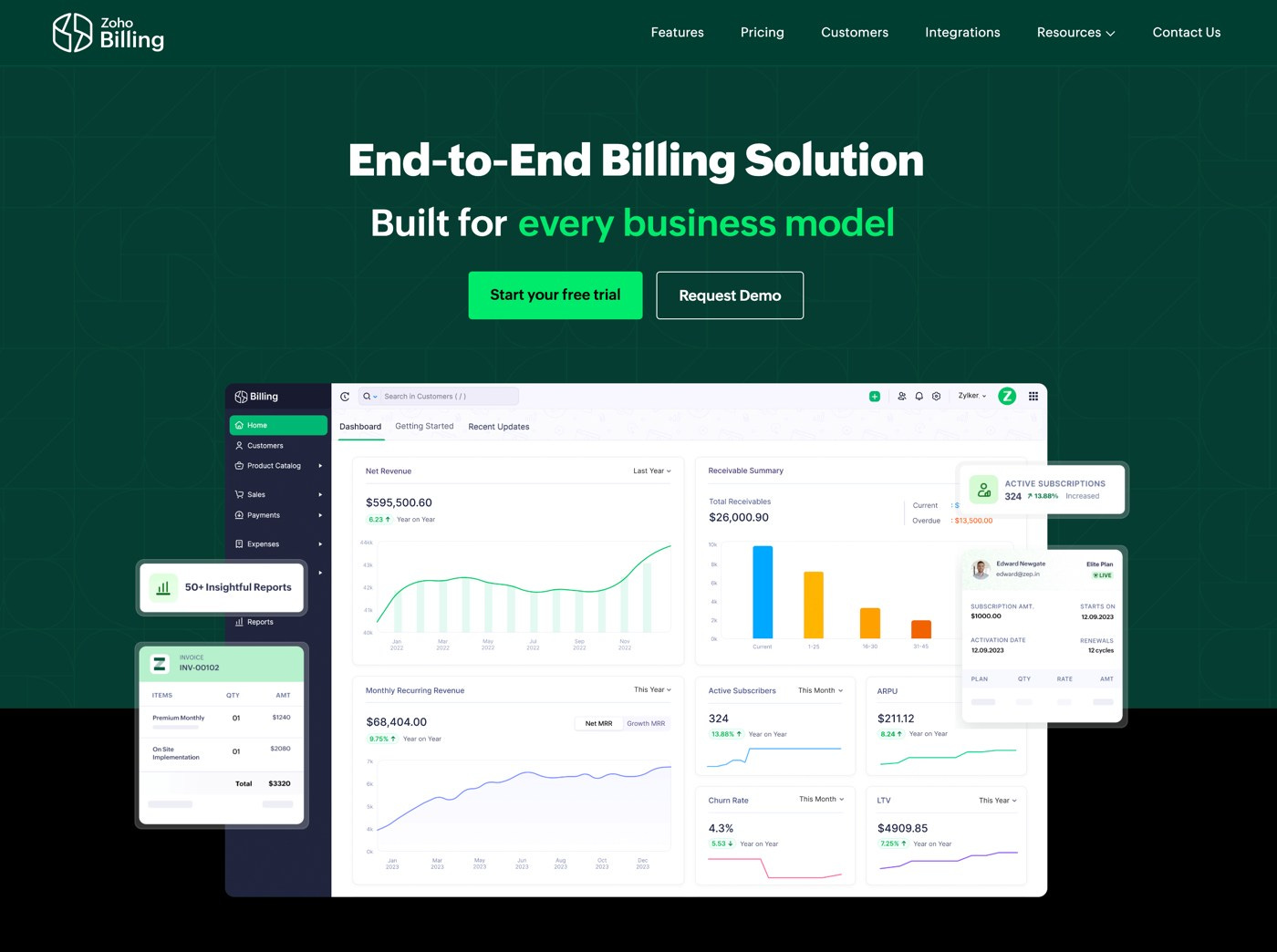

3. Zoho Billing

Zoho, a renowned software solutions provider, has expanded its product range by launching Zoho Billing, an advanced billing software that builds upon its existing Zoho Subscriptions application. With the increasing adoption of subscription models in businesses, managing recurring billing and key metrics has become a growing challenge. Zoho Billing addresses these issues by offering an intuitive interface and a range of billing functionalities, including estimates, retainer invoicing, one-time billing, and more.

Zoho Billing is specifically designed to help businesses streamline their billing operations more efficiently. It offers four pricing plans and a mobile app for managing billing tasks on the go. Zoho's commitment to smaller communities and its recent partnership with Payoneer highlight its dedication to providing businesses with comprehensive financial solutions. Read more

4. Book Now Pay Later

Booking.com customers can now pay for their trips in monthly or bi-weekly installments thanks to a partnership with Affirm. The flexible payment option comes as more consumers turn to buy now, pay later (BNPL) services for travel, with a research study commissioned by Amadeus finding that 84% of consumers would use installment payment options for their next trip. However, BNPL vendors may struggle to make inroads into the travel industry as it is dominated by credit card products with rich travel rewards and perks. Read a PR on Affirm website.

5. EV payment platform

EMVCo has formed an Electric Vehicle Open Payments Task Force to explore how EMV payment technology can support secure and seamless EV charging payments. The Task Force will engage with industry stakeholders to promote simple and convenient payments that meet the expectations of EV users. Priorities include integrating EMV Specifications with existing EV charging standards, exploring dedicated EMV Specifications for EV charging payment products, and supporting security evaluation processes. EMVCo aims to enable a secure and seamless EV charging payment experience, which has the potential to further ease adoption of zero-emission vehicles. Read more