Hey, Nikita is here!

In Payments News Weekly, I read all the payments news and summarize them in one weekly email so you don’t have to.

If you liked this newsletter, consider also subscribing to dedicated LinkedIn page.

If you’re not a subscriber, here’s what you missed in:

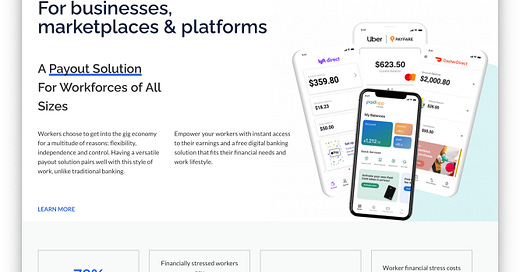

Fiserv expanding embedded finance capabilities in Canada by acquiring Payfare

What happened

Fiserv, a leading global provider of payments and financial services technology, has announced its acquisition of Payfare, a Canadian company specializing in earned wage access (EWA) solutions for gig economy workers. The deal is valued at approximately $140 million USD.

These addition is expected to strengthen Fiserv’s solutions in embedded banking, payments, and lending, particularly for large enterprises and financial institutions.

Source: Paymentsjournal

What does it mean

Embedded financial services is definitely a hot topic this days. Customers expect to see financial services in place they operate and not to switch to other platforms.

To make financial services successful the key is to provide great customer experience by smoothly integrating it with a platform.

It is ‘exciting Time' for pay by bank and open banking thinks Trustly CPO

What happened

Trustly’s Chief Product Officer, Adam D’arcy, describes the current period as an “exciting time” for the adoption of pay-by-bank technology.

While open banking has gained traction in regions like the United Kingdom and Hong Kong, the United States is beginning to embrace its potential.

Source: PYMNTS

What does it mean

Many expert I was speaking to emphasizes that user experience is what pausing the pay by bank adoption.

Solutions like Apple Pay, Shop Pay, Stripe Link provide the level of confidence and convenience.

I think there should be a significant shift in the industry for pay by bank to expand to a new level. For example if Apple Pay will add pay by bank as a payment method.

There also a need for a customer incentive similar to cards which is absent these days. Customers typically earn 1-5% cashback or miles back on every card purchase.

There are no incentives with pay by bank.

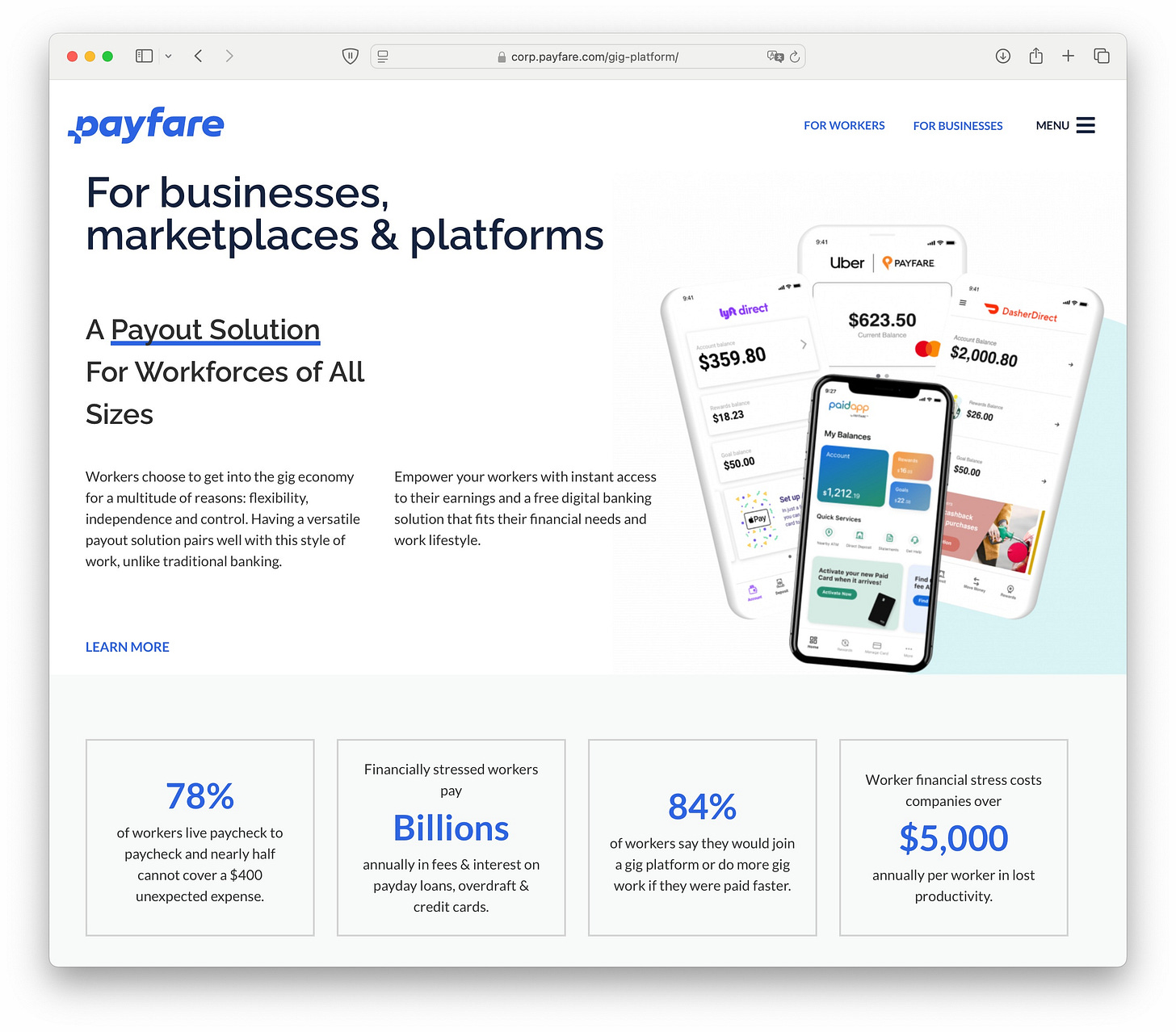

WhatsApp continues their payments expansion in India

What happened

The peer-to-peer payments service integrated within the WhatsApp messaging platform, is now available to all users in India. This expansion follows the National Payments Corporation of India’s (NPCI) decision to remove the previous user cap, which had limited the service to 100 million users. With this change, WhatsApp’s entire Indian user base, estimated at over 500 million, can now access and utilize the payments feature.

Launched in 2020, WhatsApp Pay operates on India’s Unified Payments Interface (UPI), enabling users to send money directly to their contacts from within the app.

This development positions WhatsApp Pay as a significant player in India’s digital payments landscape, offering a convenient and widely accessible option for seamless money transfers among users nationwide.

Source: Finextra

What does it mean

Is WhatsApp becoming a super app? Yes!

WhatsApp payments are also integrated with WhatsApp Business allowing businesses to manage payments together with messages.

This is also a great example of utilizing UPI payment method in India.

I am very curious with WhatsApp expansion to other markets.

X CEO confirming plans to launch payments in 2025

What happened

X announced plans for a payment system called X Money, aiming to enhance user connections on the platform. CEO Linda Yaccarino highlighted the transformative potential of this initiative.

What does it mean

I think an approach of adding payments to the platform doesn’t necessarily result in user adoption.

Personally I still don’t see a use case for payments or money transfers on X in the US. If it is going to compete with Zelle, Venmo, CashApp, what are X’s advantages for customers? Happy to be wrong on this one.

If you liked this newsletter, consider sharing it:

Thank you for reading!

– Nikita